Taxes

Federal Judge Rules Cook County Property Tax Foreclosures Unconstitutional: What Real Estate Professionals Need to Know

Passionate writer sharing insights, expertise, and knowledge on various topics to inspire and inform readers worldwide.

A federal court just upended Cook County's property tax sale system—and real estate attorneys, agents, and investors need to understand what this means for their clients and deals.

If you work in Cook County real estate, this ruling changes the landscape. Tax sale investments are now legally uncertain, distressed property acquisitions face new complications, and clients who lost homes to tax foreclosure may have actionable claims.

On December 9, 2025, U.S. District Judge Matthew F. Kennelly issued a landmark decision in a class-action lawsuit representing more than 1,700 Cook County homeowners. The ruling found that the county's property tax sale system violates both the Fifth Amendment's protection against taking property without just compensation and the Eighth Amendment's ban on excessive fines.

How the System Works—And Why It's a Problem

Here's how Cook County's tax sale system operates: When a homeowner falls behind on property taxes, the county can obtain a judgment against the property. The county then holds an annual tax sale where private investors bid for the right to pay off the outstanding taxes, fees, and penalties.

If the homeowner can't repay that debt within two and a half years, the investor can obtain a tax deed and take ownership of the property outright. The original homeowner loses not just their home, but all the equity they've built up over years or decades.

Consider the real numbers from the lawsuit. Michelle Kidd, a bus driver from Maywood, bought her home in 2011 with no mortgage. After becoming disabled, she fell behind on her taxes. In 2017, Cook County sold the tax lien on her home for $2,340.44—the amount she owed. When she couldn't repay the debt by 2019, she lost her home entirely. The property was valued at $166,220. Kidd received nothing.

Another plaintiff, Goyce Rates, inherited her Evanston home in 2014. She fell behind on taxes totaling $9,025.45. She lost a home valued at $389,060.

Illinois Stands Alone

In May 2023, the U.S. Supreme Court ruled unanimously in Tyler v. Hennepin County that this kind of "home equity theft" violates the Constitution. The case involved a Minnesota widow whose $40,000 condo was seized over a $15,000 tax debt. The county kept the entire sale proceeds.

Chief Justice John Roberts wrote that the taxpayer "must render unto Caesar what is Caesar's, but no more."

Since that ruling, every other state that had similar practices has reformed its laws. Illinois is the only state that hasn't.

Cook County argued it shouldn't be liable because it was following state law, and because private investors—not the county—ultimately receive the property. Judge Kennelly rejected those arguments, writing that the county "initiated the process" that resulted in homeowners losing their properties and equity.

The Disproportionate Impact on Black and Latino Communities

The lawsuit highlights a stark racial disparity. More than 75% of parcels in Cook County's 2021 tax sale were located in majority Black and Latino neighborhoods—even though Black and Latino residents make up only 52% of the county's population.

A 2025 investigation found that the initial debts that cost people their homes totaled $2.3 million collectively, but those homes had a combined market value of over $108 million. In most cases, this represented a direct transfer of wealth from Black neighborhoods to outside investors.

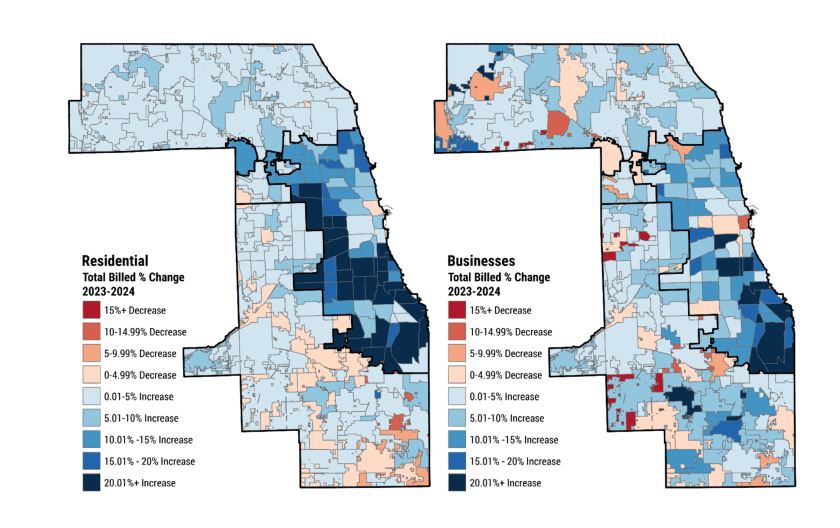

Homeowners in these communities also appeal their tax assessments less frequently than those in wealthier areas, which compounds the problem when bills spike—as they did this year with increases of 50% to 133% in some South and West Side neighborhoods.

What Happens Next

The court's ruling doesn't immediately put money back in homeowners' pockets. Judge Kennelly left open the question of whether Cook County is financially liable for the losses and how compensation should be calculated. Briefings are due December 13, with a status hearing set for December 16.

In the meantime, Cook County Treasurer Maria Pappas has delayed the county's fall tax sale until March 2026, hoping the Illinois legislature will finally pass reform legislation. Pappas has advocated for changes that would ensure homeowners are fairly compensated after a property tax foreclosure.

But given that lawmakers have failed to act for more than two years since the Supreme Court's Tyler ruling, homeowners shouldn't assume help is coming from Springfield.

What This Means for Real Estate Professionals

For Real Estate Attorneys: This ruling creates both risk and opportunity. Clients who acquired properties through tax sales may face title challenges or claims from former owners seeking equity recovery. Conversely, if you have clients who lost properties to tax sales, they may now have viable claims worth pursuing. The class in this lawsuit represents over 1,700 homeowners—but there are likely many more who haven't come forward.

For Tax Sale Investors: The tax lien investment model in Cook County is now on shaky legal ground. Some investors have already sued the county treasurer over what they call "worthless" tax certificates. Until Illinois reforms its laws, acquiring properties through tax deed carries significant legal uncertainty. The county has delayed its fall tax sale until March 2026, but even if sales resume, the underlying constitutional problem remains unresolved.

For Agents Working with Distressed Sellers: If you have clients facing property tax delinquency, the calculus has changed. Previously, losing a home to tax sale meant losing everything. Now, there's at least a legal pathway to recovering equity—though the process is uncertain and slow. Helping clients understand their options before a property goes to tax sale is more important than ever.

For Title Companies: Properties acquired through Cook County tax sales now carry additional risk. Title searches should flag tax sale history, and underwriting decisions may need to account for potential claims from former owners.

What Real Estate Professionals Should Do Now

Audit your pipeline. Identify any pending transactions involving properties acquired through tax sales. These deals may need additional due diligence or title insurance considerations.

Review client histories. If you've represented clients who lost properties to tax sales and received nothing for their equity, reach out. They may have claims worth pursuing.

Advise distressed clients early. Homeowners facing tax delinquency need to understand their options—payment plans, appeals, exemptions—before their property goes to sale. Waiting until after a tax deed is issued limits everyone's options.

Watch Springfield. The Illinois legislature has failed to reform tax sale laws for over two years since the Supreme Court's Tyler ruling. Whether they act before March 2026 will determine how this plays out.

Consult on complex situations. If you're dealing with a tax sale property—whether as buyer, seller, or former owner—get legal guidance specific to your situation.

Author