Taxes

Cook County Reopens Property Tax Appeals for ALL Townships Through December 12

Passionate writer sharing insights, expertise, and knowledge on various topics to inspire and inform readers worldwide.

If you're a Cook County homeowner who watched in disbelief as your property tax bill arrived—months late and hundreds or thousands of dollars higher than expected—you're not alone. And now, you have an unexpected opportunity to do something about it.

The Cook County Board of Review has reopened property tax appeals for every township in the county, with a filing deadline of December 12, 2025. This rare move comes after "unprecedented circumstances" created by the four-month delay in mailing second installment bills.

Why This Matters for Chicago Homeowners

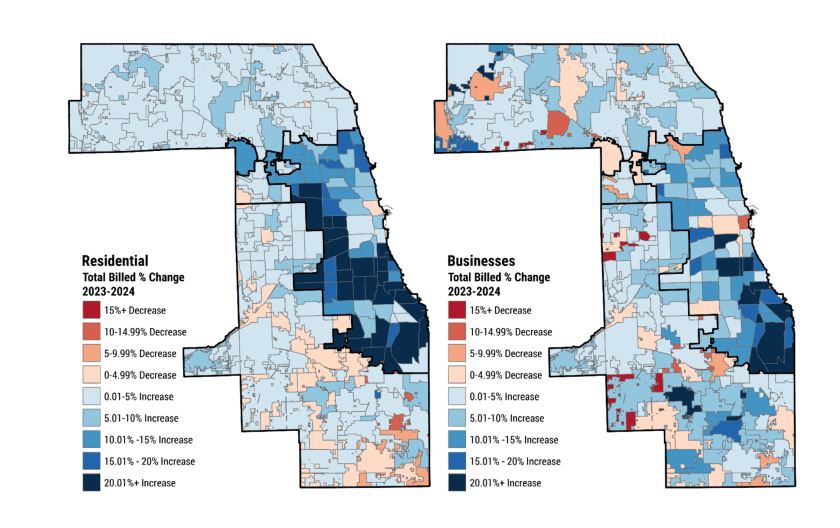

The numbers are staggering. According to the Cook County Treasurer's Office, the median residential tax bill in Chicago jumped 16.7%—the largest increase in 30 years. But for homeowners on the South and West sides, the situation is far worse:

West Garfield Park: 133% increase (roughly $2,000 more per household)

North Lawndale: 99% increase (nearly $1,900 more)

Englewood: 82% increase

Meanwhile, commercial properties in the Loop are paying $130 million less than last year.

"When the Loop gets a cold, the rest of the city gets pneumonia," Cook County Treasurer Maria Pappas said.

What Happened and Why You're Paying More

Normally, property tax bills arrive by July 1. This year, they weren't mailed until November 14—a four-month delay that caught homeowners off guard right before the holidays.

The spike in residential bills stems from a perfect storm: commercial property values in the Loop plummeted during the pandemic as offices emptied and hybrid work became permanent. That lost value—$379 million in the Loop alone—shifted the tax burden onto homeowners elsewhere.

The result? Families who have owned homes for generations are suddenly facing bills they can't afford. One Garfield Ridge homeowner reported his bill doubled from $9,600 to $19,100 on a home his great-grandfather built in 1916.

How to File Your Appeal Before December 12

The Board of Review is accepting appeals through December 12, 2025, with supporting evidence accepted until December 22. Here's what you need to know:

Who can file:

Any Cook County property owner in a township that already closed its 2025 appeal window

People who haven't already appealed this year

How to file:

Online at appeals.cookcountyboardofreview.com

In-person at the Cook County Building

At upcoming Board of Review community events

What you'll need:

Your Property Index Number (PIN)

Evidence supporting a lower assessment (comparable sales, photos, documentation of property issues)

Verification that your property record is accurate (check square footage, property classification, and exemptions)

Cost: Free

Important: This Won't Lower Your Current Bill

Here's the catch—any successful appeal affects next year's second installment bill, not the one due December 15, 2025. You'll still need to pay your current bill or set up a payment plan with the Treasurer's Office.

But if your assessment is too high, appealing now protects you from overpaying again in 2026.

Check Your Property Record for Errors First

Before filing, Board of Review Commissioner Samantha Steele recommends verifying:

Your property's square footage matches reality

The property classification is correct

You're receiving all exemptions you qualify for (homeowner's exemption, senior freeze, veteran's exemption)

Errors in any of these categories could be inflating your bill unnecessarily—and may qualify for a Certificate of Error correction.

The Bigger Picture

This situation has become a flashpoint in local politics, with county officials pointing fingers at each other. Cook County Assessor Fritz Kaegi blames the Board of Review for cutting commercial property assessments by nearly 20% while residential assessments stayed flat. The Board of Review blames Kaegi's initial valuations.

Meanwhile, a "circuit breaker" bill is pending in Springfield that would provide relief to homeowners who see increases of 25% or more. It mirrors laws in 29 other states—but hasn't passed yet.

For now, the appeals window is your best immediate option.

When to Talk to a Real Estate Attorney

While you can file an appeal yourself, the process can get complicated—especially if you're dealing with significant overassessments, commercial property, or errors that require a Certificate of Error. A real estate attorney can help you build a stronger case, navigate the system, and maximize your chances of a successful appeal.

Author