Legal

Cook County Property Tax Spike 2025: What Real Estate Professionals Need to Know

Passionate writer sharing insights, expertise, and knowledge on various topics to inspire and inform readers worldwide.

Chicago homeowners just received the largest property tax increase in 30 years. If you work in real estate, this isn't just news—it's a client retention opportunity hiding in plain sight.

The Numbers Behind the 2024 Tax Increase

Cook County mailed 1.8 million second-installment tax bills on November 14, 2024, with payment due December 15. The median Chicago residential bill jumped 16.7% this year—roughly $4,457 for the typical homeowner.

But citywide averages obscure the real story. Commercial property values in the Loop have collapsed, shifting hundreds of millions in tax burden onto residential owners. Loop commercial buildings saw their tax load cut by over $129 million, while homeowners citywide absorbed approximately $470 million in additional taxes.

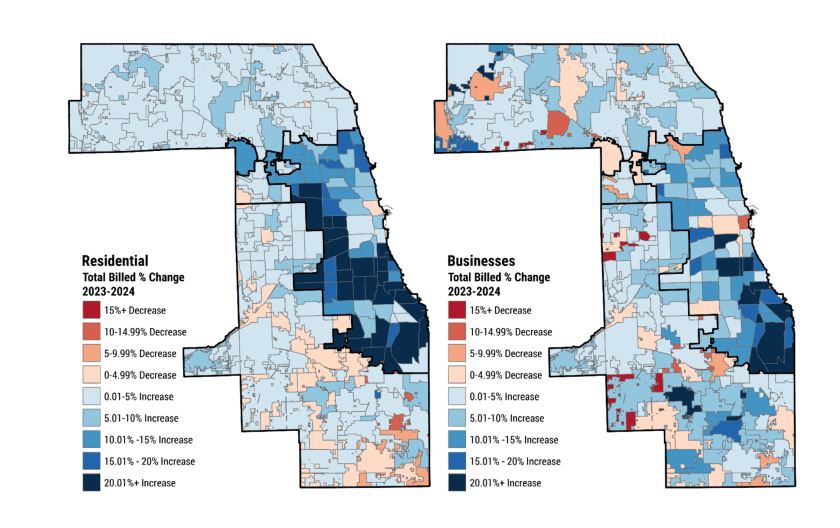

Neighborhood-Level Impact

The increases hit hardest in predominantly Black neighborhoods on Chicago's West and South Sides. West Garfield Park saw median bills more than double—a 133% increase representing nearly $2,000 in additional annual taxes. North Lawndale experienced a 99% jump. Nine community areas with majority Black populations saw median bills rise more than 50%.

This pattern follows years of disproportionate tax burden in south and southwest suburban communities, where collection rates have already declined—a clear indicator of financial strain preceding this latest increase.

Why Your Clients' Monthly Payments Are Changing

Most mortgaged homeowners won't write a check to Cook County. Instead, they'll see their monthly mortgage payment increase—often without understanding why.

When property taxes rise, lenders recalculate escrow requirements. The delayed billing cycle this year means many servicers are sending payment change notices now, weeks before the holiday season. For households already stretched thin, an unexpected $150-200 monthly increase can push them from stable to delinquent.

Illinois already operates one of the country's most aggressive tax foreclosure systems. Investigative reporting has documented how this regime has stripped more than $100 million in home equity from over 1,000 owner-occupants—disproportionately Black families—over relatively small tax debts. This year's spike layers additional risk onto communities already vulnerable to that system.

Actionable Steps for Real Estate Professionals

This tax cycle creates a legitimate, valuable reason to contact past clients. Here's how to make that outreach count.

Verify Exemption Status

Exemptions remain the most powerful lever for reducing tax burden. The Cook County Assessor applies exemption savings to second-installment bills, making this the right moment to confirm clients have claimed everything available: Homeowner Exemption, Senior Exemption, Senior Freeze, and disability-related exemptions. Many exemptions auto-renew, but gaps occur. Missed exemptions from prior years can often be recovered through Certificates of Error.

Explain Escrow Mechanics

Clients who bought during the low-rate environment of 2020-2021 may have never experienced a significant escrow adjustment. Walk them through the math: higher assessed value multiplied by higher tax rate equals higher annual tax, divided by twelve and added to their existing mortgage payment. Their interest rate hasn't changed—but their total housing cost has.

Connect Struggling Clients to Relief Programs

The Cook County Treasurer offers a 13-month installment plan at 0.75% monthly interest for homeowners who cannot pay by December 15. Getting clients enrolled in structured payment arrangements before penalties accumulate is far better than letting small debts compound into foreclosure risk.

The Business Case for Proactive Outreach

Most real estate professionals disappear after closing. The agents and attorneys who build lasting referral networks are the ones clients hear from when circumstances turn difficult—rate shocks, reassessments, unexpected tax increases.

A brief, informed check-in about property taxes positions you as an advocate rather than a transactional service provider. It costs nothing but time, and it surfaces clients who may be considering selling, refinancing, or referring family members to someone they trust.

This tax cycle is painful for Chicago homeowners. It's also an opportunity to demonstrate the kind of ongoing value that separates forgettable closings from career-long client relationships.

Author