Taxes

Property Tax Appeals 101: Understanding Your Rights in Cook County

Passionate writer sharing insights, expertise, and knowledge on various topics to inspire and inform readers worldwide.

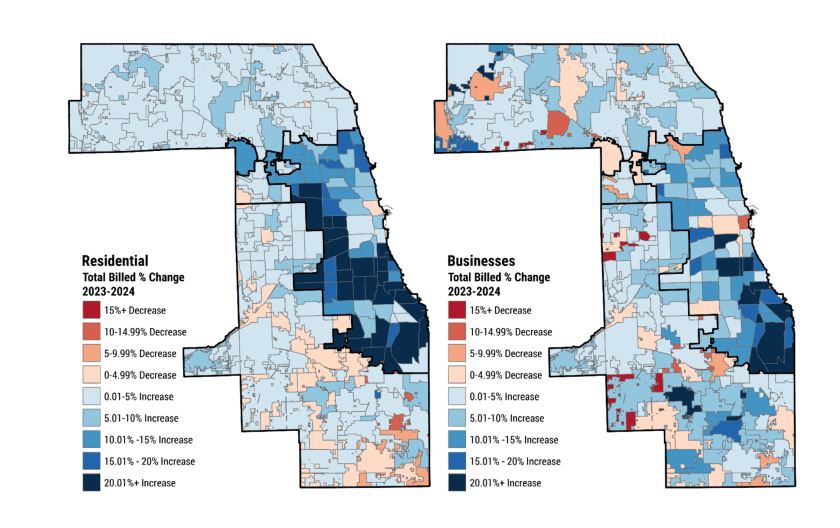

Property taxes represent one of the largest expenses for homeowners and businesses in Cook County. Unfortunately, many property owners are paying more than their fair share due to inaccurate assessments. At Younis Law Group, we regularly help clients successfully navigate the appeals process to secure significant tax savings.

Why Consider a Property Tax Appeal?

The Cook County Assessor's Office is responsible for valuing over 1.8 million parcels, and errors are common. Our experience shows that approximately 60% of properties are overassessed, yet most owners never appeal. This means many taxpayers are unnecessarily overpaying year after year.

The Cook County Appeals Process

Property tax appeals in Cook County follow a specific timeline:

Township Reassessment Schedule: Cook County operates on a triennial reassessment cycle, with different townships reassessed each year.

Filing Deadlines: After receiving your reassessment notice, you typically have 30 days to file an appeal with the Assessor's Office.

Board of Review: If unsatisfied with the Assessor's decision, you can appeal to the Cook County Board of Review.

Illinois Property Tax Appeal Board: For further appeals, cases can proceed to the state level.

Grounds for Appeal

Successful appeals typically involve:

Comparable Property Analysis: Demonstrating similar properties are assessed at lower values

Income Approach: For commercial properties, showing the assessment exceeds capitalized income value

Recent Purchase or Appraisal: Using recent arms-length transactions to establish fair market value

Property Condition: Documenting factors that negatively impact value

The Value of Professional Representation

While property owners can file appeals independently, our clients benefit from:

Deep knowledge of valuation methodologies

Access to comprehensive comparable property databases

Experience with complex documentation requirements

Strategic approaches tailored to property type and location

The appeals process requires attention to detail and understanding of legal deadlines. Missing a filing window can mean waiting another year or more for relief.

Contact Us

If you believe your Cook County property may be overassessed, contact our property tax team for a complimentary review of your assessment. Our contingency fee structure means we only get paid when we successfully reduce your tax burden.

Author